Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

How to improve your receivables turnover ratio

Since AR turnover benchmarks do not offer the best data, how can you analyze your metrics? For instance, we can define Acme’s business sector as “wholesale food supply” instead of “consumer non-cyclical.” CSI’s study lists the retail, consumer non-cyclical, and transportation sectors as the best performers. Sales allowances include credit notes or any other allowance you offer your customers.

Accounts Receivable Turnover Ratio – What does it mean?

But nearly half of them claim those cash flow challenges came as a surprise. And create records for each of your suppliers to keep track of billing dates, entering invoices and receipts side by side in xero amounts due, and payment due dates. If that feels like a heavy lift, consider investing in expense tracking software that does the organising for you.

Limitations of the receivables turnover ratio

Learn more about Bench, our mission, and the dedicated team behind your financial success. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Finance Strategists has an advertising relationship with some of the companies included on this website.

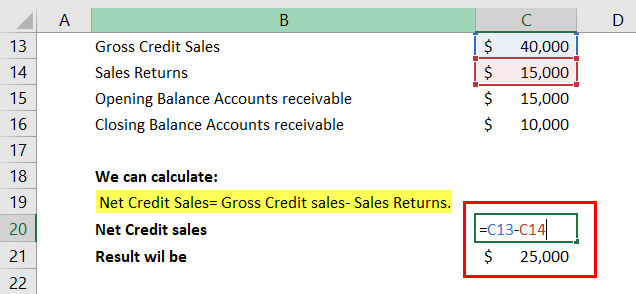

This is usually calculated as the average between a company’s starting accounts receivable balance and ending accounts receivable balance. Use this accounts receivable turnover calculator to quickly determine how many times your company collects its average accounts receivable in a year. Here is a receivables turnover calculator, which computes how quickly a company turns over its receivables, or sales extended on credit to customers. Enter the company’s net credit sales (or, optionally, top line sales) and two period’s accounts receivable to compute the ratio. Given the accounts receivable turnover ratio of 4.8x, the takeaway is that your company is collecting its receivables approximately five times per year.

Accounts Receivable Turnover Ratio: What is it and How to Calculate it

- A higher accounts receivable turnover indicates that a company is collecting payments from its customers more quickly.

- However, a ratio of less than 10 is generally considered to be indicative of a company having Collection problems.

- You should be able to find your net credit sales number on your annual income statement or on your balance sheet (as shown below).

- Doing so allows you to determine whether the current turnover ratio represents progress or is a red flag signaling the need for change.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. For our illustrative example, let’s say that you own a company with the following financials.

Using your receivables turnover ratio, you can determine the average number of days it takes for your clients or customers to pay their invoices. The receivables turnover ratio measures the efficiency with which a company is able to collect on its receivables or the credit it extends to customers. The ratio also measures how many times a company’s receivables are converted to cash in a certain period of time. The receivables turnover ratio is calculated on an annual, quarterly, or monthly basis. Accounts receivable turnover measures how many times the company’s accounts receivables have been collected during an accounting period. The accounts receivable turnover ratio measures how efficient your AR processes are.

Yes, accounts receivable turnover can be used as one of the metrics to assess a company’s creditworthiness. A higher turnover ratio suggests better credit management and a lower risk of default, while a declining ratio may raise concerns about the company’s ability to collect payments in a timely manner. Congratulations, you now know how to calculate the accounts receivable turnover ratio. The Accounts Receivable Turnover Ratio indicates how efficiently a company collects the credit it issued to a customer. Businesses that maintain accounts receivables are essentially extending interest-free loans to their customers, since accounts receivable is money owed without interest.

Additionally, the AR turnover ratio may not be particularly informative for businesses with significant seasonal variations. In such instances, it becomes more valuable to focus on accounts receivable aging as a more relevant metric. Firstly, since the AR turnover ratio is an average, it can be influenced by customers who either make unusually early or exceptionally late payments, potentially distorting the outcome. Since sales returns and sales allowances are outflows of cash, both are subtracted from total credit sales. Low A/R turnover stems from inefficient collection methods, such as lenient credit policies and the absence of strict reviews of the creditworthiness of customers.

This way, businesses will have more capital at disposal which can then be used for other purposes like expansion or even debt repayment if necessary without affecting business operations. Because of decreasing sales, Tara decided to extend credit sales to all her customers. Liberal credit policies may initially be attractive because they seem like they’ll help establish goodwill and attract new customers. Although that may be true, nothing negates positive feelings like having to hassle someone over unpaid bills.