Financial accounting plays a critical part in keeping companies responsible for their performance and transparent regarding their operations. A cash flow statement is used by management to better understand how cash is being spent and received. It extracts only items that impact cash, allowing for the clearest possible picture of how money is being used, which can be somewhat cloudy if the business is using accrual accounting. Financial accounting rules regarding an income statement are more useful for investors seeking to gauge a company’s profitability and external parties looking to assess the risk or consistency of operations.

Part 3: Free online quiz creator – OnlineExamMaker

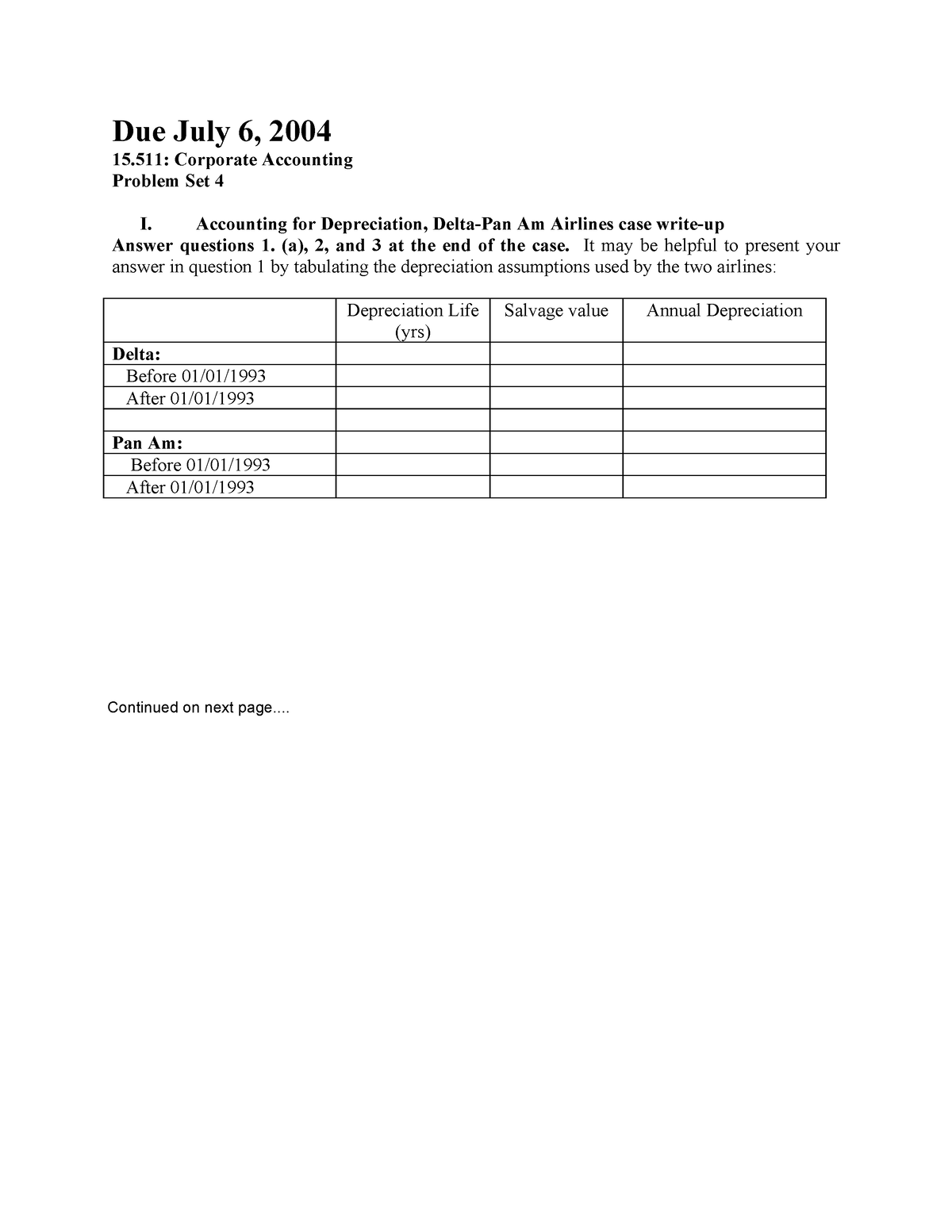

Communicating financial information to non-financial stakeholders involves translating data into clear insights that drive decisions. Bridging the gap between financial concepts and strategic goals requires technical proficiency and the ability to tell a compelling story with data. Managing fixed assets involves tracking depreciation, maintenance, and compliance. Understanding these factors ensures accurate reporting and maximizes asset value, requiring strategic thinking and attention to detail.

- Some of the factors that may be considered include the company’s financial position, Cash Flow, profitability, and business strategy.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- The transaction is recorded as a debit to cash and a credit to unearned revenue, a liability account.

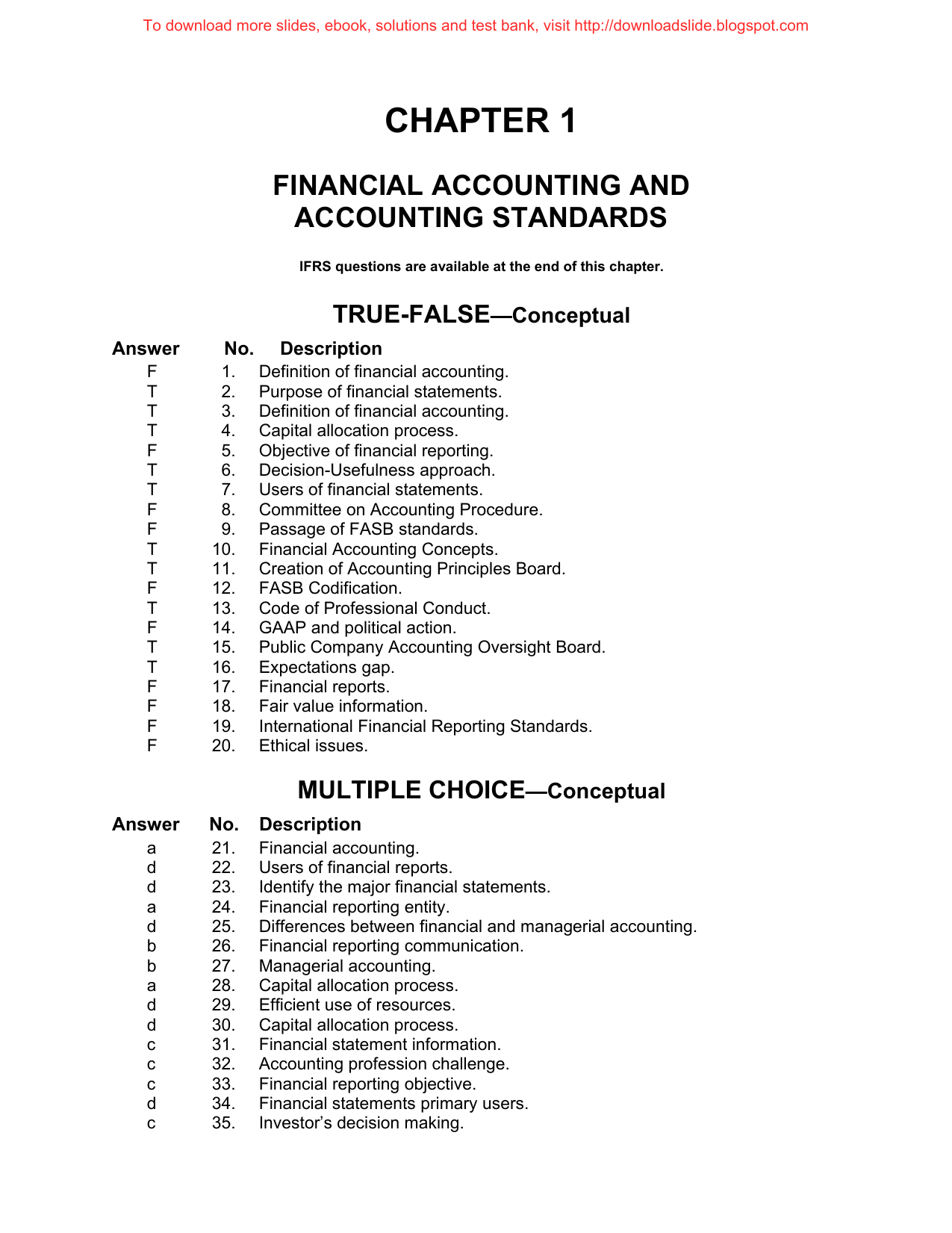

Users of Financial Accounting/Financial Statements

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Do you own a business?

Work opportunities for a financial accountant can be found in both the public and private sectors. A financial accountant’s duties may differ from those of an accountant who works for many clients preparing their accounts, tax returns, and possibly auditing other companies. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Understanding how tools like AI and cloud-based software streamline workflows and reduce errors reflects adaptability and integration into traditional practices. During high-pressure financial reporting periods, prioritizing tasks effectively showcases organizational skills and the ability to manage stress while maintaining quality. This involves strategic thinking and adaptability, balancing competing priorities without compromising financial integrity. In this example, the General Fund paid and recorded as an expenditure all of an invoice that included a portion that pertained to another fund. The Enterprise Fund should record an increase in expense at the time the reimbursement is made.

Even though the charges relate to services incurred in July, the cash method of financial accounting requires expenses to be recorded when they are paid, not when they occur. An income statement can be useful to management, but managerial accounting gives a company better insight into production and pricing strategies compared with financial accounting. An income statement, also known as a “profit and loss statement,” reports a company’s operating activity during a specific period of time.

Financial accounting is a specific branch of accounting involving a process of recording, summarizing, and reporting the myriad of transactions resulting from business operations over a period of time. Maintaining an accurate general ledger is fundamental to financial reporting integrity. It serves as the central repository of transactions, supporting compliance, strategic planning, and identifying discrepancies. Financial accounting is intended to provide financial information on a company’s operating performance.

With OnlineExamMaker software, you can easily enhance your assessment procedures, save time on grading, and gain valuable insights into learner performance. OnlineExamMaker grades quizzes automatically, average collection period formula how it works example and gives you access to detailed exam reports and statistics instantly. The insightful analytics help teachers and trainers gain valuable insights, enabling them to optimize their teaching methods.

Its primary purpose is to provide relevant and reliable financial information to external stakeholders, such as investors, creditors, regulators, and the general public. The information generated through financial accounting helps users make informed decisions about the company’s financial health and performance. It lists the company’s assets, liabilities, and equity, and the financial statement rolls over from one period to the next. Financial accounting guidance dictates how a company records cash, values assets, and reports debt. In accounting, decision-making is the process of choosing between two or more courses of action to achieve the desired outcome.

Revenues and expenses are accounted for and reported on the income statement, resulting in the determination of net income at the bottom of the statement. Assets, liabilities, and equity accounts are reported on the balance sheet, which utilizes financial accounting to report ownership of the company’s future economic benefits. The accrual method of financial accounting records transactions independently of cash usage. Revenue is recorded when it is earned (when a bill is sent), not when it actually arrives (when the bill is paid).

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Ensuring accuracy in complex tax returns is vital for maintaining integrity and reputation.